What comes to mind when you consider a diminishing economy?

Factories are closing down. There has been a surge of employment losses, with few available vacancies. Substantial financial losses have devastated the majority of the industry. That is not the case in America right now, despite the country’s GDP falling for two consecutive quarters, fitting one formal definition of a recession.

So, what is going on, and where are we going? Both issues may be answered in the country’s stockrooms.

Putting it all together: According to the initial report from the Commerce Department published Thursday, US GDP decreased at an annualized pace of 0.9 percent in the second quarter. This follows a 1.6 percent decrease in the year’s first three months.

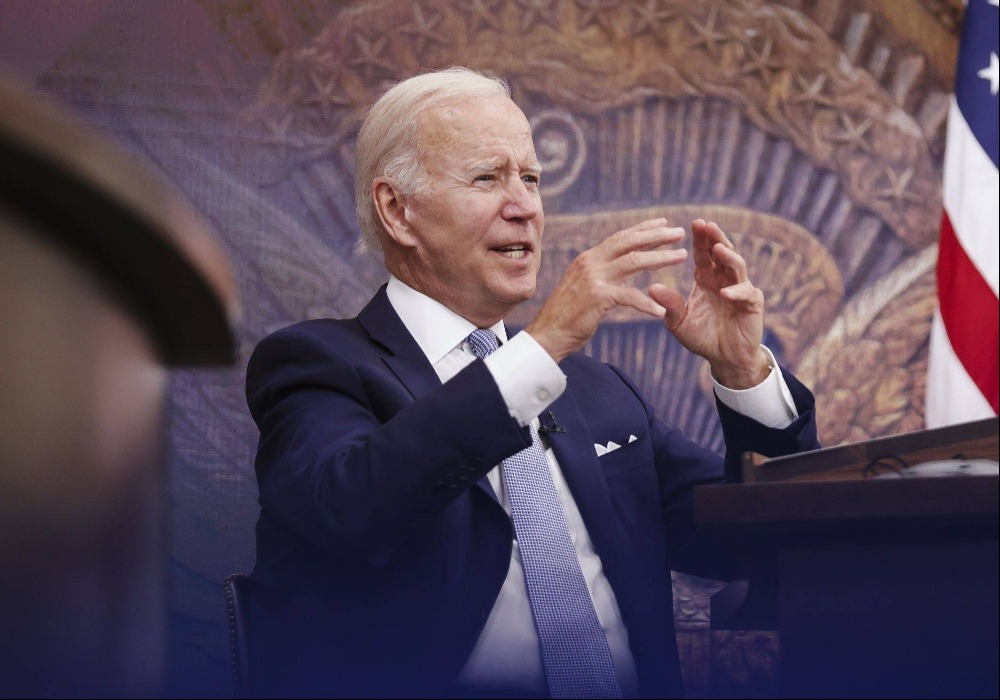

The report sparked a discussion about whether the United States is already in a recession, which analysts have warned is a concern as the Federal Reserve raises interest rates and inflation dampens consumer spending.

For one thing, Federal Reserve Chair Jerome Powell does not believe this time has arrived – at least not yet.

“I do not believe the United States is now in a recession,” Powell stated earlier this week. “There are simply too many sectors of the economy that are operating well.”

However, GDP does not just go negative on its own, and Thursday’s report provides essential context for comprehending a complicated economic situation.

Pay attention: Inventories, or products kept by a firm but not yet sold, had a significant influence.

Businesses stocked up on various commodities late last year to avoid supply chain issues and guarantee they could satisfy rebounding demand.

However, in recent months, they’ve recognized they have too much merchandise, particularly at this uncertain time for manufacturers and buyers, and have been cautious in making fresh orders.

The following slowdown in inventory accumulation led to a major portion of the loss between April and June, reducing economic production by a shocking two percentage points.

Why it matters: According to some analysts and businessmen, the growth that began at the end of 2021 was accelerated, making the activity in the first half of 2022 appear artificially low.

Chief investment officer at CBIZ Investment Advisory Services Anna Rathbun stated, “The fourth quarter, to me, was swollen a little bit.” “Everyone was simply stockpiling.”

However, this does not mean that inventory levels should be ignored. They include useful indicators for determining how quickly the US economy may deteriorate from here on out.

The rate of increase in US inventories, which Ed Cole, managing director of discretionary investments at Man Group, told me he constantly monitors “as an indicator of where we are in the cycle,” has two primary components.

Companies will not place fresh orders if customers buy fewer items, damaging manufacturing productivity.

If businesses are compelled to sell undesirable inventory at steep discounts, sales and profits will suffer.

“Recent warnings by prominent merchants have proved this effect,” he continued.

Walmart (WMT) cut its profit forecast this week, saying customers’ buying patterns are shifting. This necessitates markdowns to clear off surplus inventories of things such as apparel.

It is not the only organization experiencing this issue. American Outdoor Brands (AOBC) states, “rapidly rising inflation and borrowing rates….have contributed to driving up stock levels.” Hasbro (HAS) also stated that its inventory levels were “greater than average” for the time of year, but it highlighted that its stock was of “very good quality.”