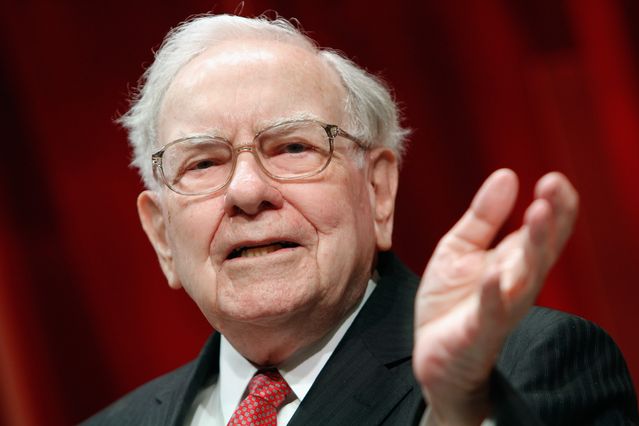

In the first quarter of 2022, Berkshire Hathaway bet big on the US stock market. It bought more than $51 billion of shares. However, we also saw a big slide in financial markets as the global economy has been taking a downturn.

Warren Buffet’s Berkshire Hathaway was a seller of stocks in the last two years. However, global markets have gone weak recently. This is because of many things, such as fears of an economic shutdown in China and Russia invading Ukraine.

Here is what you must know about Berkshire Hathaway.

A Dent In The Cash Pile Of Berkshire Hathaway

Buying stocks is not easy, as it will always put a dent in your pocket. The same thing happened to the cash pile of Berkshire Hathaway, as they bought billions of dollars worth of shares. By the end of March, the company’s cash pile was well from over $147 billion to $106 billion.

According to the company’s first-quarter report, it has sold more than $9 billion of stock during this time. The report indicated that the company was a net buyer of shares worth over $40 billion at the start of the year. It was the most active quarter for the company in recent times.

What Stocks Did Berkshire Hathaway Purchase?

According to the report, Berkshire used the purchase of shares to increase its ownership of Chevron, an energy company. Such an investment in this company also accompanies Occidental, HP, and more stock purchases. According to Warren Buffet, he has also directed Berkshire to purchase millions of shares in the gaming company Activision Blizzard.

Microsoft agreed to acquire this company at the start of the year, which is why Buffet suggested this move. Berkshire Hathaway purchased at least fifteen million shares, and it now owns more than 9% of the company. They are the largest shareholder of Activision Blizzard.

Funding The Investments

Of course, Berkshire also needs money to fund its investments and adventures in the stock market. Besides that, they also spent more than $3 billion on share buybacks, which is why they needed a way to invest. So, Berkshire sold or let securities and treasuries worth over $40 billion mature in the quarter.

The money from the sale of these securities led to Berkshire purchasing the share of other companies. However, still, the company reported a net income of more than $5 billion in the first three months of this year. This is less than half the level of income that they generated last year.

Final Words

While Berkshire Hathaway might not have enjoyed the same level of income as last year in the first three months, the reports show that it’s manufacturing, utilities, and railroad business will report strong profits in the coming quarter. Of course, we are yet to see what will happen. Berkshire shares have completely outpaced the stock market of the United States this year, as they rose at least 7.5% this year as compared to a decline last year.